Chief Financial Officer

-

The Chief Financial Officer's Office includes many vital departments, services, and programs for all schools, departments, and the community.

The Chief Financial Officer is responsible for the following departments:

Business Office and Bids

Budget and Finance

Taxes

-

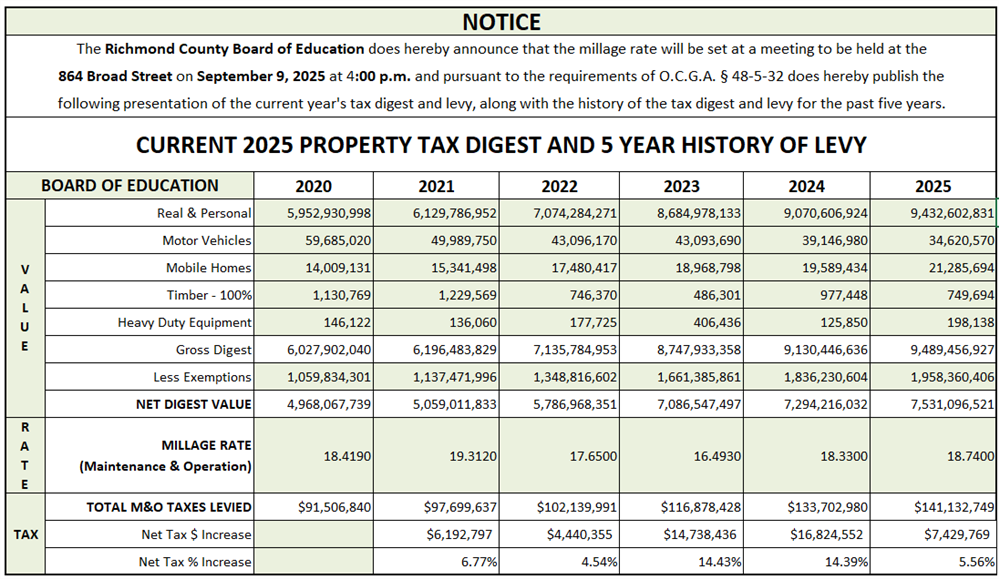

NOTICE OF PROPERTY TAX INCREASE (8.12.25)

The Richmond County School Board has tentatively adopted a millage rate which will require an increase in property taxes by 5.33 percent.

All concerned citizens are invited to the public hearing on the tax increase to be held at the County’s Board of Education building, 864 Broad Street, Augusta, GA on August 25, 2025 at 12:00 p.m. and 6:00 p.m.

A time and place of an additional hearing on this tax increase will be held at the County’s Board of Education building, 864 Broad Street, Augusta, GA on September 2, 2025 at 5:00 p.m.

This tentative increase will result in a millage rate of 18.74 mills, an increase of 0.948 mills. Without this tentative tax increase, the millage rate will be no more than 17.792 mills.

The proposed tax increase for a home with a fair market value of $200,000 is approximately $71.10 and the proposed tax increase for non-homestead property with a fair market value of $250,000 is approximately $94.80.

SPLOST

-

The citizens of Richmond County voted for a Special Local Option Sales Tax to support the school system in three major areas: textbooks, transportation, and technology. Phase 6 of the SPLOST was voted on and approved by the tax payers for the period of July 1, 2022 thru June 30, 2027. An oversight committee was formed to oversee the spending of these funds.The citizens of Richmond County voted for a Special Local Option Sales Tax to support the school system in three major areas: textbooks, transportation, and technology. Phase 7 of the SPLOST was voted on and approved by the tax payers for the period of July 1, 2027 thru June 30, 2032. An oversight committee was formed to oversee the spending of these funds.See the Citizen's Oversight Pay-As-You-Go Committee for more information.

Contacts

-

Bobby A. Smith, CPA

Chief Financial Officer

Jeanice Barrett

Executive Administrative Assistant

706.826.1114